GROW YOUR CAREER in the mortgage industry!

We always have our eyes and ears open for talented individuals that align with our culture, seek new heights, and are willing to commit to excellence.

- An ambitious loan officer looking to grow your career?

- Have a proven track record in mortgage originations?

- A self-starter passionate about delivering exceptional service

Take a look at what Buckhead Home Loans offers

With over 100 investors/banks operating in the wholesale market, it’s not a stretch to say that if there is a product, we either have it, or we can get it.

In addition to all of the “vanilla” stuff with Fannie, Freddie, FHA, VA, RD, and Jumbo – here are a few programs that expand the product offering allowing the originator to keep their pipelines full.

- No Overlays

- FHA/VA – down to 500 score

- DPA – multiple options

- DSCR / No Ratio Investor Loans

- Bank Statement Loans

- Stated Income Primary Residence

- Hard Money & Fix and Flip

- Reverse Mortgages

Utilizing an advanced Loan Origination System (LOS), Point of Sale (POS), and Product and Pricing Engine (PE) creates a competitive advantage!

Arive is a single platform for managing loan origination, borrower interactions, and pricing, providing an efficient and streamlined process. By combining the LOS, POS, and PPE into one simple to use platform, Buckhead loan officers spend less time structuring and keeping track of their loans.

At Buckhead, loan officers choose the investor and the business channel that best fits the scenario, whether it be a loan program, a guideline appetite, pricing, turn time, or any other reason.

With over 100 wholesale investor relationships, Buckhead loan officers can utilize the broker channel to gain access to virtually every loan program available.

Buckhead offers mini correspondent lending with 6 of our investors. Closing and funding in Buckhead’s name gives the loan officer greater control of the process by utilizing our initial disclosures, our AMC, and provides less constraints on pricing/comp disclosure.

Over the top support is who we are and what we are about – and we have the experience to back it up.

It all starts at the top with a hands-on owner who has been in the mortgage business for nearly 30 years. Engaged daily with sales training, product training, and loan troubleshooting with the single goal of guiding the originator to achieve their goals, whatever they may be.

Our in-house processing and closing staff are simply the best in the business. Critical thinking ability combined with a white glove customer service approach can make even the most difficult loan or borrower a walk in the park. They are ready to put their years of experience to work.

At Buckhead Home Loans, loan officers have the freedom to choose the processing option that works the best. Regardless of the processor used, the Buckhead staff is always available and stands ready to assist however needed.

Buckhead loan officers can take advantage of our in-house processing team. Our experienced team of processors will handle the loan from contract to closing. This service is included at no charge for all Traditional and Apprentice Compensation plans. For Transaction based loan officers, our in-house processors are available for a $695 fee.

Loan officers that are on a Transaction based compensation plan, may use a third-party contract processor of their choice. Third-party processors must be licensed and approved by Buckhead prior to starting work on any loan.

Buckhead loan officers, on a Transaction compensation plan, may elect to self-process their loans. This is a great option for seasoned loan officers who are capable and comfortable taking on the responsibility.

If you want to have a long and successful career in the mortgage business, you need to know loan programs and guidelines, but even more importantly, you also need to know how to find the business. There are many originators that claim to be “guideline gurus” but are completely paralyzed when it comes to marketing. They simply miss the fact that this industry, like many others, is 95% marketing and 5% execution.

From simple direct mail, internet, and social media campaigns to more complex data driven niches, we love marketing and are always looking and experimenting with new marketing ideas that drive activity to our originators. From new business development to post close client retention, we have all the systems in place.

Each loan officer has a personalized landing page and URL of their choice that is integrated with our LOS (Arive), Point of Sale (POS), and any other online submission forms needed.

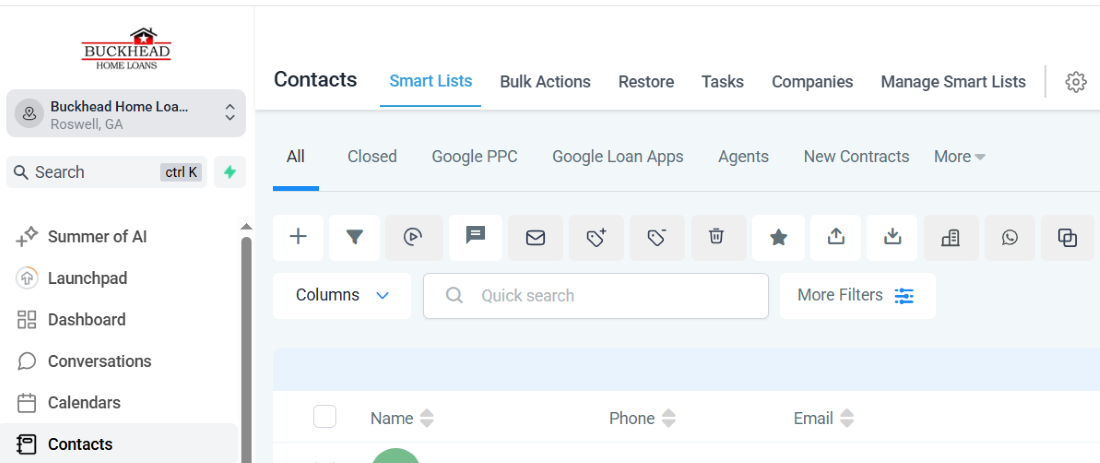

Our CRM is built on the GoHighLevel platform providing a seamless integration for lead capture, marketing campaigns, and appointment booking via email and SMS with a dedicated Twilio number.

Whether you are a seasoned loan officer or brand new to the industry, our comp plans are designed to provide loan officers a stable platform for freedom, support, and growth opportunities.

Traditional Model - up to 122 bps

The traditional model is designed for loan officers that have experience and desire a strong support system while working in a fixed bps (up to 122 bps) comp model for each closing. With technology, processing, and credit report fees covered by Buckhead Home Loans, this is a great, and time-tested, model for the solo loan officer looking for steady growth.

Transaction Model - $995 transaction fee

The transaction model is designed for seasoned professionals that have built a good book of business and want to earn more from every closing. By taking on some of the expenses, loan officers have full access to our support systems, investors, and business channels while only paying a $995 transaction fee on each loan closing. This is a great model for loan officers looking to take their career to the next level.

Revenue Sharing

Revenue sharing program designed to create residual income for recruiting and retaining successful MLO’s.

W2 or 1099

Depending on the state of licensing, loan officers may elect to be compensated on a 1099 basis or by a W2. We rely on guidance from state regulators to determine the compensation method.

Payroll is completed weekly (Wednesday) for all loans that have been finalized as of Friday the week prior.

If you are on a W2, we will deduct 10% (after transaction, processing, and other fees) for the employer portion of the FICA/Unemployment tax.

Buckhead Home Loans is everything you should expect from a brokerage, plus more.

Founded in 1998, we have been around long enough to have seen several market environments. Our history gives us clear insight that market conditions do not dictate the long-term success of a company. If long-term success is to be achieved, the people must be the backbone of the operation. Experience, leadership, wisdom, and support must all be present to provide an environment where an originator can find success, even set personal records, regardless of external market forces.

Put the power back in your hands as an originator with the tools, resources, and compensation plans that fit the way you work. Whether you are new to the mortgage industry or a seasoned originator, Buckhead could be the place for you.

From the beginning, we have operated in the mortgage broker channel as we believe this is the most efficient way to serve our clients. At times, we have explored moving to a “retail lender” by bringing all functions in-house but each time we moved this way, we quickly realized why the broker channel is where we need to stay.

While the broker channel has matured in recent years, the channel still presents challenges for today’s originators that need to be overcome. Limits with loan portability regarding disclosures and appraisals both present challenges to the pure broker model. But our way eliminates these challenges.

OUR Way – is a hybrid model technically known as a Non-Delegated Correspondent Lender (NDC). With this model we get ALL the flexibility of a full lender but retain ALL the benefits of a mortgage broker. The result is an operation that delivers the best of both worlds.

With OUR WAY, you are the lender, so you control pricing, disclosures, appraisal, and closing. But we still utilize the same wholesale lender partners for pricing and underwriting. The result is a highly competitive product delivered in the most efficient way.

Request More Information

Would Buckhead be a good fit? Fill out the questionnaire and let’s start a conversation to find out.